https://www.instagram.com/p/DFnUbN4uyaV/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA==

Author: aibnsamin

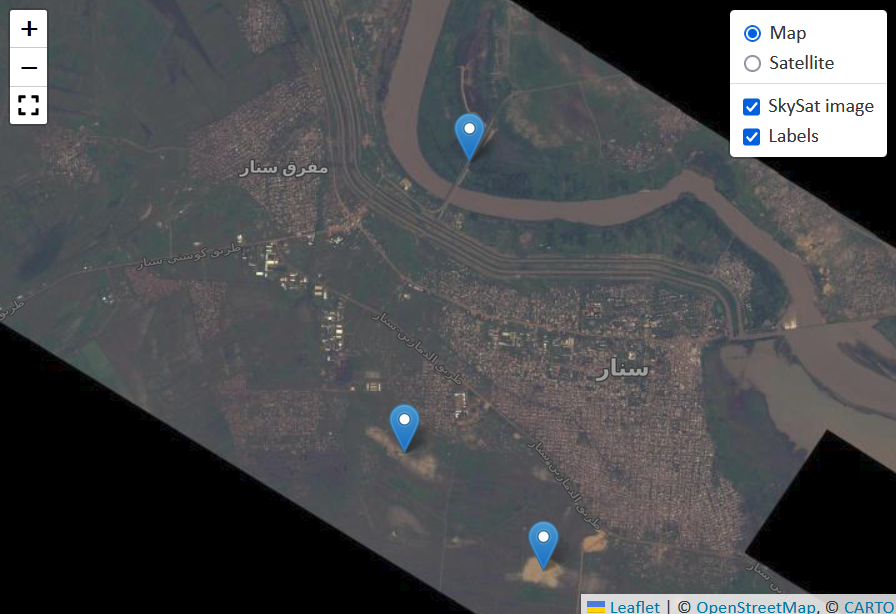

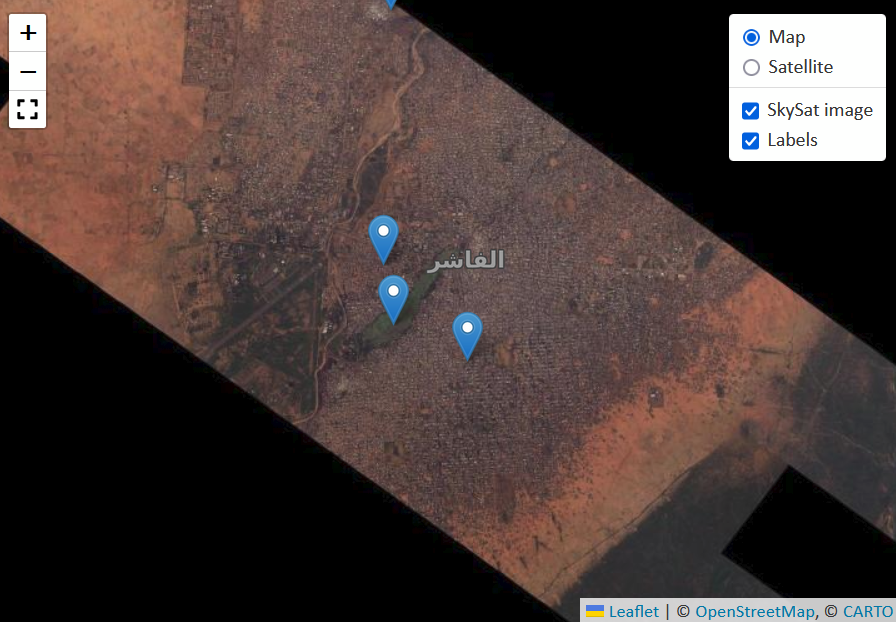

Sennar and Al Fashir in Sudan

In recent months, fighting between the Rapid Support Forces (RSF) and Sudanese Armed Forces (SAF) has intensified in Sennar State in Sudan’s southeast. Initially a paramilitary force controlled by a faction of the Sudanese government, the Sudanese Armed Forces designated the RSF a rebel group after RSF attacks on government sites in April last year. Since then, the two forces have battled for control of the country.

@opalrose on Bellingcat’s public Discord server requested a tasking of the state capital city of Sennar.

In Planet Labs PBC SkySat imagery captured on August 31, the most noticeable features are agricultural flooding, a result of the unusually heavy rains that also caused a dam collapse in northwest Sudan.

North of Sennar City, what appears to be a checkpoint can be seen on Sennar Bridge.

SkySat imagery captured on August 31, 2024, by Planet Labs PBC.

Al Fashir is the largest city in the Darfur region and the last stronghold of the Sudanese Army in Darfur. Bellingcat previously reported on the fighting between the RSF and SAF and attacks on hospitals and the power station. Agricultural and urban flooding is also visible in the city, including around the market and residential areas of the Abou Shouk internally displaced refugee camp, an area where civilians have been targeted by the Rapid Support Forces.

While the satellite tasking captured the majority of the city, the northeastern part of Al Fashir is absent, where the Rapid Support Forces are keeping the city under siege and where civilians are heavily impacted.

My Journey as CEO

As CEO of JuristAI, I’m fortunate to be at the helm of a company that’s truly transforming the legal industry. Over the past few months, I’ve had the chance to reflect on how far we’ve come and the immense opportunities that lie ahead. I want to share some insights on our journey, recent milestones, and what drives me as we move toward disrupting one of the most traditional industries in the world.

Building an AI-Powered Legal System

JuristAI is not just another legal tech startup—we are pioneering what we call the “first legal-care company,” a revolutionary concept aimed at democratizing access to high-quality legal services. Our products are like having an AI-powered law firm in your pocket, and our mission is to make legal services accessible for everyone, not just legal professionals.

The problem we are solving is clear: legal fees are too high, and navigating the law is complex. Whether you’re a startup founder or a general user, the inefficiency and high cost of legal services are prohibitive. Lawyers, especially, are stuck in outdated workflows, spending only a fraction of their day on billable work while drowning in administrative tasks.

To address this, we built a modular platform that rapidly pivots to different legal verticals. AtticusAI, our flagship product, focuses on Federal criminal defense, and SeriesAI supports startups by automating essential legal document drafting like SAFE notes and Series A funding agreements. Both products are designed to streamline legal workflows, reduce inefficiencies, and provide complete document drafting capabilities.

A Unique Approach to Legal Disruption

The unique value of JuristAI lies not just in its products, but in our platform’s agility. Our core architecture can expand rapidly into new practice areas, allowing us to address pain points across different legal sectors efficiently. AtticusAI and SeriesAI are just the beginning. Our goal is to provide AI-powered legal solutions across various legal fields—from IP law to civil litigation—tailored specifically to the needs of both lawyers and the general public.

What makes us different from competitors like Harvey, LexisNexis+AI, and Paxton AI is our emphasis on practice-area specificity, full document drafting, and advanced error/hallucination detection. This isn’t just about automating mundane legal tasks; it’s about providing attorneys, business owners, and the public with tools that can truly make the law work for them.

Recent Wins and the Path Ahead

This past month has been a whirlwind. We’ve made significant progress in development and are getting ready to launch AtticusAI this October. Our partnerships with AWS Startups and Microsoft Startups Founders Hub have positioned us for rapid growth, and we’re already seeing two law firms piloting our products. Furthermore, we are currently raising a seed round to fuel our expansion, and we’ve seen strong investor interest as we tap into the $800 billion global legal market.

Our journey is not without challenges. Balancing the social mission of democratizing legal access while creating a scalable, profitable business has been my focus as CEO. Every day, I’m driven by the belief that JuristAI can be both a socially responsible company and one with a clear path to a billion-dollar valuation.

Looking Forward

As we move forward, the core message remains the same: JuristAI is revolutionizing legal practice. We are not only improving efficiency in legal processes but also democratizing access to legal services for everyone. The next few months are critical for us as we continue to refine our products, expand our team, and engage more customers.

It’s been an incredible journey so far, and I couldn’t be more excited for what lies ahead. Stay tuned as we continue to disrupt the legal world one product at a time.

Feel free to visit us at juristai.org and atticusai.org to learn more about our progress.

The Infinite Monkey Theorem is a famous thought experiment in probability theory that suggests that given an infinite number of monkeys, typewriters, and time, one of those monkeys will eventually type out a complete work like Shakespeare’s Othello. In theory, every possible sequence of characters will eventually emerge because, with infinite resources, even the most improbable outcomes are guaranteed.

However, what if this assumption doesn’t hold up when we move from theoretical infinity to practical infinity?

The Infinity Exhaustion Paradox

In a theoretical run of infinite possibilities, every event, no matter how remote, is guaranteed to happen because infinity ensures that every outcome will be actualized. It’s a mathematical abstraction where probability and time are treated as limitless resources.

But in a real, actual run of infinite possibilities, it’s possible that some extremely remote possibilities may never occur. This is because certain outcomes might require an infinite amount of time to appear—even if infinite time is granted. For example, the monkey typing Othello might never actually happen in practice, as the time needed for such an event could itself stretch into infinity.

This presents a significant critique of the Infinite Monkey Theorem, which I call the “Infinity Exhaustion Paradox.” It suggests that even with infinite resources, certain rare outcomes may never manifest because they are infinitely improbable in any meaningful, practical sense.

Refuting the “Infinity Exhaustion Fallacy”

The “Infinity Exhaustion Paradox” can be seen as a counterpoint to the “Infinity Exhaustion Fallacy” often implied in theoretical discussions of probability. The fallacy assumes that infinite time and possibilities automatically lead to the actualization of all potential events. But the paradox highlights that even in infinite scenarios, some events could be so remote that they require an infinite amount of time to occur, making them practically impossible.

Theoretical vs. Actual Infinity

This distinction touches on deep areas of mathematics and philosophy, including set theory, modal realism, and the philosophy of probability. It’s similar to ideas in constructive mathematics, where the focus is on what can actually be realized, as opposed to abstract infinite assumptions.

In conclusion, the Infinity Exhaustion Paradox challenges the classical interpretation of infinite probability by introducing the possibility that even in an infinite world, certain outcomes may remain forever out of reach. If this concept has not yet been formally described, I propose this name to encapsulate the idea that infinite time may not guarantee the realization of all possibilities.

This post explores the nuances between theoretical and practical infinities and offers a potential framework for discussing the limits of infinite probability. Whether or not this idea has been explored in full, the “Infinity Exhaustion Paradox” presents an intriguing new angle on the Infinite Monkey Theorem.

Atticus – AI’s Legal Revolutionary

The IT & software world has recently been rocked by advancements in AI. This wave of innovation introduces an unprecedented tool that stands to revolutionize the legal field JuristAI’s: Atticus.

Generative Pre-trained Transformers

One of the most groundbreaking developments in AI technology is OpenAI’s advancement in Generative Pre-trained Transformers (GPT). Unlike traditional Recurrent Neural Networks (RNN) and Convolutional Neural Networks (CNN), GPT produces “transformer” architecture. Using a large language model (LLM) and natural language processing (NLP), GPT can process an extensive dataset and produce human-like responses to prompts.

LLMs use a two-step process, allowing for translation, question-and-answer, or sentiment analysis. The model is first pre-trained on an enormous dataset to learn general language understanding and generation before user interaction. Then, it’s fine-tuned on a task- or domain-specific smaller dataset for particular use cases. This process, coupled with advanced training techniques, produces highly coherent and contextually relevant responses.

Introducing JuristAI

JuristAI has chosen this model for its sophistication in the field and its API offerings that allow us to fine-tune our models. We can train individual models on datasets as large or as small as desired. This allows JuristAI to provide defense attorneys a tool that can nearly instantly draft briefs, thereby combating endemic inequities in criminal justice.

Beyond Briefs and Motions

But JuristAI does not intend to stop at briefs and motions. It is the beginning of a wider project to leverage generative artificial intelligence in all areas of American law. In the long term, JuristAI intends to expand internationally, revolutionizing legal systems across the globe.

Atticus is proud to be the first generative AI that can draft entire motions and briefs. We are not just offering a chatbot, but a comprehensive solution that includes discovery analysis, brief drafting, and other features. By increasing workflow efficiency, we aim to give attorneys an unmatched competitive advantage.

Welcome to the future of the legal field.

American criminal law has seen an incredible consolidation of power in the hands of the prosecutors over the last five decades. With a conviction rate of 97%, the time-worn adage of “indicting a ham sandwich” has become, “in the US, you can convict a ham sandwich.”

At that point, the fundamental pillars of the social contract which binds the government to the people are being shaken. Americans do not trust the legal system, they do not trust the judicial branch, they do not trust the courts, they do not trust prosecutors. They don’t trust them because the system seems, and is, unfair.

Bipartisan efforts at criminal justice reform have done little to remedy the problem. Once a defendant is in the crosshairs of a prosecutor, there is little they can do to ensure that their rights are upheld. They cannot ensure that they are afford the presumption of innocence which is the cornerstone of constitutional rights.

If we can’t fix it through legislation then how? If we can’t fix it through advocacy then how? If we can’t fix it through education then how?

It is time for the latest innovations in artificial intelligence to be put towards social ends. Instead of being the harbinger of a techno-dystopia, AI should be utilized to improve society. Instead of replacing valuable work, it should be used to maximize existing humanitarian or social justice resources.

The Federal government and Federal defense attorneys should adopt AI to help them protect defendants. It is the only path forward to a system that is criminal justice instead of criminally unjust.

Are Cryptocurrencies Halal?

بسم الله الرحمن الرحيم

Table of Contents

1. What is the Shari’a?

2. What is Fiqh?

3. What is Fatwa?

4. What is Economics?

5. What Kind of Financial Instruments or Transactions Are Prohibited?

6. What is Currency?

7. What is the Blockchain?

8. What is Cryptocurrency?

9. Is Bitcoin Halal?

10. Conclusion

11. Notes

Introduction

The question of cryptocurrencies and their relationship with Islam has been hotly debated for nearly the last ten years. A seemingly unending amount of fatawa have been issued and discussions held on this topic. Nearly every stance has been passionately argued by knowledgeable scholars. However, no single discussion or verdict issued yet has been exhaustive.

Many of the fatawa issued on cryptocurrencies are based on a priori reasoning pertaining to many aspects of the shari’a, economics, and cryptocurrencies. In order to reach a thoroughly reasoned and robust conclusion on this topic, not only must every aspect of the reality of cryptocurrencies be investigated – but so must every aspect of the current international economic order. However, this must be done in a methodical fashion which takes into account Islamic values.

Muslim specialists in the field of blockchain and cryptocurrencies are almost always severely under-educated regarding Islamic sciences. As few as cryptocurrency specialists are, the number of them who are actively engaged in the field of Islamic studies or who are interested in holding robust discussions with the scholarly class are even slimmer. The intersection between knowledge in this burgeoning field and basic competency in Islamic knowledge is currently remarkably small.

The following represents the only exhaustive study of cryptocurrencies, blockchain, Bitcoin, the greater economic system they seek to provide an alternative to, and Islamic finance. While this study does not seek to draw conclusions regarding controversial topics in Islamic studies, it does seek to come to an ultimate conclusion as to the permissibility of cryptocurrencies. In doing so, it must inevitably cover some of those topics; however it attempts to do so with a level of objectivity.

We ask Allah سبحانه و تعالى to accept this humble effort.

1. What is the Shari’a?

The Arabic word shari’ah comes from the trilateral root [ش-ر-ع]. Linguistically, it refers to a path (shaari’). Allah uses various disambiguations of this word in the Qur’an five times [Concordance of the Qur’an by H. Kassis]. The shari’ah is the path from the worldly life [dunya] to the paradisaical Garden [Jannah]. It defines what things are on the path, within the boundaries of Islam, and what things lead you off of the path.

Shar’i-compliant is a modern term to describe financial instruments or economic policies which are in according with the boundaries of the Din. Muslims are allowed to engage in trade and business insofar as those things are in accordance with the shari’a. The kinds of financial instruments or transactions which are outside of the scope of the shari’a’s boundaries may not be engaged in.

The Shari’a is Revelation from Allah and cannot be altered. However, certain specific areas of the Shari’a can be interpreted differently by different traditionally-trained Islamic scholars, i.e., ‘ulama. As a result, in order to create a normative framework and scope wherein the Shari’a can be reliably understood as per the intent of the Lawgiver – i.e., Allah – ‘ulama exerted their efforts towards the science of fiqh, which is discussed further below.

It is necessary, before engaging in a thing, to know the ruling of Allah and His Messenger ﷺ upon it. Therefore, a person could not engage in cryptocurrency transactions without first knowing that ruling.

a. The Aims of the Shari’a

The great architect of revised Ash’ari theology, Shafi’i usul, and Islamic spirituality, Abu Hamid al-Ghazali and his teacher al-Juwayni, first articulated the concept that the Shari’a has overarching aims, i.e., maqasid, which its individual rulings intend to accomplish [Maqasid al-Shar’iyya al-Islamiyyah by Al-Kayyani Ahmad Salih]. While there is no doubt that this concept existed prior to Imam al-Ghazali, his articulation set out maqasid as an independent topic for further study.

Less than two centuries later, the Andalusian Maliki jurist – Abu Is’haq al-Shatibi (not to be confused with Abu Mohammad, al-Qasim al-Shatibi, the Andalusian qira’at scholar) penned the first fleshed out work of Maqasid al-Shari’ah.

Abū Isḥāq Ibrāhīm Ibn Mūsā Al-Shāṭibī’s theory of maqasid al-shari’a can be understood as reconciling between deontological and consequentialist moral frameworks. To al-Shatibi, Divine Commands naturally lead to the best consequences and Divine Commands are God’s Law [Imam al-Shatibi : Theory of the Higher Objectives and Intents of Islamic Law, Ahmad al-Raysuni,, pg. 358-359]. According to Al-Shatibi, the Lawgiver has certain aims regarding His Revelation of Divine Commands. The Lawgiver legislates in order to facilitate the material and spiritual well-being of all people, to avoid an imbalance in the natural order of human life. He sends down Laws to remove hardship and difficulties, to make human living beautiful, good, and conformant with higher spiritual realities.

As such, Shatibi posited a sort of middle-ground between deontological and consequentialist morality. To al-Shatibi, God’s Laws must lead to the best consequences, and this is an observable phenomenon both rationally and experientially. To him, there is no difference between “the greatest good for the greatest number” and God’s Laws. The true greatest good can only be achieved by God’s Laws, and it is also possible to conduct an analysis of His Laws to recognize the aims of the His Laws [al-Raysuni]. These principles, maqasid, then become their own form of knowledge and are superior even to the traditional jurisprudential epistemology in Islamic law. They are their own moral epistemological framework.

Generally speaking, the overarching aims of the Shari’a are:

- Preservation of Din

- Preservation of Life (Nafs)

- Preservation of Mind (Mental Health)

- Preservation of Wealth

- Preservation of Family

- Preservation of Honor

- Preservation of Society

We are primarily concerned with preservation of wealth (hifzh al-mal) in this discussion.

2. What is Fiqh?

Fiqh is an Arabic term. Linguistically it means “wisdom” or “understanding.” It is mentioned in the Qur’an according to that meaning twenty times. The Prophet Muhammad ﷺ said:

وَعَنْ مُعَاوِيَةَ قَالَ: قَالَ رَسُولُ اللَّهِ صَلَّى اللَّهُ عَلَيْهِ وَسَلَّمَ: «مَنْ يُرِدِ اللَّهُ بِهِ خَيْرًا يُفَقِّهْهُ فِي الدِّينِ وَإِنَّمَا أَنَا قَاسِمٌ وَاللَّهِ يُعْطِي»

“Whomsoever Allah wishes good for, He grants wisdom [fiqh] in the Din. I am only a distributor, Allah is the One who gives.” [Bukhari and Muslim]

In terms of Islamic sciences, fiqh teaches Muslims how to traverse the Shari’a. It deals with the mechanics and rulings of worshiping Allah. The books of fiqh cover the rulings of all actions. Scholars of fiqh [fuqaha] have discussed everything from ritual purity, food, prayer, governance of states, to financial transactions.

Fiqh is where we will look in order to find out the Shar’i stance on cryptocurrency.

a. Fiqh During the First Generation

After the death of the Prophet ﷺ, his companions focused on studying five primary sciences: Qur’an, Sunnah, Islam, iman, and ihsan [Sahih Muslim 8a & Al-Muwaṭṭa’ 1661]. At this time, there was no formal distinction between these sciences nor a precise methodology to take students from a place of absolute ignorance to mastery. The early Muslim community was relatively well-educated in the Din and close enough to the source of knowledge that there was no need for highly developed theories or academies. They could learn directly from second- or third-hand sources, come to their own conclusions, and develop ways to facilitate learning for a new generation that was not as privileged.

Initially, fiqh was not taught as its own science. Rather, Sunnah and Islam were taught [Usul al-Fiqh of the Salaf by W. Al-‘Abbas]. The Sunnah consisted of: The life of the Prophet (Sira), sayings of the Prophet, actions of the Prophet, and descriptions of the Prophet ﷺ. Islam consisted of: Properly understanding the Sunnah, studying the actions of worship, interactions with others, transactions, and politics.

b. Fiqh by the End of the Third Hijri Century

By the end of the third hijri century, the Muslim empire had stretched from East to West. After entering into China, the Muslim traders returned to the Arabian Peninsula with Chinese paper. Being easier to produce and more widely available, this allowed for the Muslim scholars to write down their knowledge.

Additionally, as the empire expanded, foreign ideas and homegrown innovators began producing a challenge to the knowledge as passed down by the Prophet’s companions. There was also the problem of unreliable students or dishonest individuals attributing themselves to knowledge.

Scholars began developing curriculums to teach specific aspects of the Din which they specialized in. This lead to the distinction and development of particular sciences. Sunna became subdivided into Sira, Hadith, and fiqh. Islam similarly divided, with a part of it being merged into fiqh, and other parts being siyasa, iqtisad, usul al-fiqh, and later, maqasid al-shari’a. [The Evolution of Fiqh: Islamic Law and the Madh-habs by B. Phillips]

Therefore, fiqh is the study of actions of worship according to the Sunnah and Islam. It is distinguished from hadith, the other component necessary to understand the Sunnah. Hadith is an objective compilation of historical records pertaining to the Prophet ﷺ whereas fiqh is the correct understanding of those narrations in light of other relevant factors [Maqasid al-Shari’ah by b. Ashur].

In order to cement that all of these sciences had a direct relationship with the bearer of Revelation, i.e., the Prophet Muhammad ﷺ, early Muslims did not depend on unreliable sources for this information. When they took information from people regarding the Din, it had to come from a teacher who also took from a reliable source. Ultimately, this chain of transmission had to end with the Prophet ﷺ. This way, it could be ensured that nothing was being taught without coming from a Revelatory source.

That process became known as sanad, chains of transmission, which was then studied in every science. It began first in Sunnah, then was adapted to all other sciences of Din. After the codification process and the writing of Islam’s mother academic texts, then sanad was transformed into the rich ijaza (license to teach) tradition – wherein a teacher consciously issues a sanad forward-looking as opposed to the backwards-looking nature of initial asanid. [Studies In Early Hadith Literature by M. M. Azami]

c. Codification of the Schools of Fiqh

Many reliable understandings of fiqh developed throughout Islamic history. However, by the seventh hijri century, the Muslim ummah had settled on six primary schools. These schools represented the bodies of knowledge and work of many scholars over hundreds of years, usually being attributed to a main representative of the school. While the schools were eponymous, it did not mean that the head of the school created it. Rather, it was the product of whatever vibrant center-of-learning that imam resided in, and whose tradition he codified.

The earliest surviving school is the school of imam Malik b. Anas, the Maliki school. Then came the school of Abu Hanifa, the Hanafi school. Then came the school of imam Mohammad b. Idris al-Shafi’i, the Shafi’i school. Finally is the school of imam Ahmad b. Hanbal, the Hanbali school. Each of these schools survives to this day. However, they have long histories of development and progression far beyond the scope of this article.

Additionally, there are two lesser acknowledged surviving schools. These are the Dhahiri and Ahl al-Hadith schools. The Dhahiri school arose in Islamic Spain and North Africa, named after Dawud al-Dhahiri. It has a decidedly literalist bent and was mostly eliminated after the Spanish Reconquista. It has not been as thoroughly codified as the other schools, though it does survive through living asanid.

The school of Ahl al-Hadith is an informal school adopted by some early jurists who were great independent legal minds (mujtahid). Since they reached a level of independence, they were able to formulate their own rulings, however these scholars did not find a large following and their legal reasoning is very hadith-oriented. Over time, Sunnis who did not follow any school of law and preferred to stick solely to narrations would attribute themselves to this informal school. This school is deemed problematic for some of its later members’ wholesale rejection of fiqh and overall lack of intellectual robustness [Who Are the Blind Followers? by Abu Usama Ayub].

Two major aspects distinguish one school from another: epistemology and views. Epistemology, i.e., usul al-fiqh, refers to how the fuqaha of a school actually determine principles. Usul are usually based on understanding the views of a major founding scholar and retroactively applying the methodology imam al-Shafi’i outlined in a famous work called al-Risala, then deriving new rulings from that derived usul. The views of the madh’hab consist of the opinions of major scholars, especially founding fuqaha, and the views of fuqaha throughout that school’s development. Ultimately, the school settles on certain views as being relied upon, and these are taught to students first.

For the purposes of this research, the opinions of authoritative scholars from all six schools will be considered – if they can be located.

d. Primary Maxims of Fiqh

The fuqaha set certain principles when understanding shar’i rulings. These principles (qawa’id) are based on various kinds of evidences. Qawa’id al-fiqh color understanding every single decision fuqaha make regarding the shari’a, so they are incredibly relevant here. The major qawa’id are:

- All worldly matters are permissible until explicitly proven haram (الأصل في الأشياء الإباحة)

- All acts of worship are impermissible until proven legislated (الأصل في العبادات التحريم)

- Actions are determined by intention (انما الاعمال بالنيات)

- Certainty is not removed by doubt (اليقين لا يزول بالشك)

- Difficulty demands ease (المشقة تجب التيسير)

- Harming is not allowed, nor is reciprocating harm (لا ضر و لا ضرار)

- Customs of the people are considered in rulings (العادة محكمة)

- The permissible is clear and the impermissible is clear (ان الحلال بين و ان الحرام بين)

- Leave that which is doubtful for that which is not (دع ما يبريك الى ما لا يبريك)

3. What Is Fatwa?

Fatwa is a concept pertaining to shari’a and fiqh. A fatwa is when a scholar discusses Allah’s decision pertaining to a matter. He then takes a ruling of fiqh [a hukm], which is general, and applies it to a real world situation. Fatwa is issued whenever a person claims that a particular belief, action, way of doing something, or avoiding a thing is part of Islam or is not a part of Islam.

However, usually the term fatwa is used to refer to an individual issuing an unprecedented ruling. The unprecedented ruling could either be due to contravening other rulings historically, the particular person’s research on an issue (usually controversial), or due to the appearance of an issue (‘illa; ratio legis) hitherto unprecedented. The first kind of fatwa is usually considered inappropriate in the scholarly community whereas the second kind is accepted depending on the subject of research and need for that research. The third kind of fatwa is absolutely necessary and keeps the fiqh tradition of Islam alive by producing new thinking in response to new problems using the legal framework laid down 1,450 years ago.

a. Who is Qualified to Issue Fatwa?

Every field of human knowledge has gradients. Individuals start their journey in a field or science as beginners and gradually increase to greater levels of knowledge. As a person increases in knowledge, he is more competent to speak about that field. The same is true of fiqh.

The most basic level pertaining to fiqh is that of the layman (‘ammi). The ‘ammi has no kind of specialized knowledge, however the ‘awwam (plural of ‘ammi) are also stratified. There is a difference between a layman who knows absolutely nothing about Islamic practices and the one who is on the verge of becoming a student of knowledge (talib al-‘ilm). Generally speaking, the ‘ammi’s views are not seriously taken and they are advised to simply practice what more competent people have told them.

In Bloom’s taxonomy of educational hierarchies, the layman is at the bottom stage. They struggle to recall basic facts and concepts and are taught rulings with the hope that they can retain them for implementation.

The talib al-‘ilm is an individual who has ascended beyond the level of general knowledge in fiqh. This individual has specialized in studying fiqh to an extent where he has a degree of competence in understanding a particular school and the science as a whole. The talib al-‘ilm is challenged by their teachers to genuinely understand concepts and ideas, as opposed to rote memorization for the purpose of being a functional Muslim.

The first level of fiqh scholarship is termed “the people of verification” or as’hab al-tas’hih. These scholars tend to comment on various legal manuals, comparing rarer or tertiary opinions, and clarifying what the default stance of their particular school is. They do not do the work of revising what opinions are strong or weak within a school’s epistemological paradigm (usul al-fiqh), but rather transmit at a higher level than a talib al-‘ilm. A sahib al-tas’hih can generally give the default hukm of a school on any topic, but may not necessarily tell you why the school has preferred this view over another.

Historically speaking, some scholars argued that this was the highest level of scholarship which could reasonably be obtained. These scholars held an extreme view that the door of juristic reasoning (bab al-ijtihad) closed here, and that scholars could only relate the views of previous, greater scholars, without determining why one view was stronger than another. It was not their place to revise the schools any more, only to preserve them.

The second level is “the people of verification” or As’hab al-Tarjih. As’hab al-tarjih investigate the opinions formed by scholars before them, utilizing their school’s epistemology (usul) to determine what opinions are most worthy of being relied upon and what opinions are weak. They sift through the views of scholars within their school on as many issues as they can, ultimately selecting one on each issue. They weigh the various positions and conclude what the school’s official, dominant positions are.

Next come As’hab al-Takhrij or “the companions of research” are scholars just under independent legal reasoning. They are highly dedicated and learned. Usually, these scholars have reached the highest level of scholarship within one particular field, but not mastered more than one. This kind of a scholar is the total authority within that field.

The first level of ijtihad is the Mujtahid fi al-Masa’il or “independent jurist in specified topics.” This kind of faqih is able to establish new precedents on issues by utilizing the school and usul of greater scholars. This scholar may actually be at a greater level of ijtihad but simply chooses to stick to the school of an even greater scholar and only formulate his own opinions on novel issues. However, these scholars are capable of restructuring the school if they wished and are not bound to the legal views of most of the scholarly class, as they have exceeded them. This would be the highest level of scholarship reasonable to reach in the modern era.

The scholars of fiqh disagree as to whether it is possible to exceed beyond the level of al-mujtahid fi al-masa’il in the modern era. Around the tenth hijri century, many scholars began claiming that the “door of ijtihad” was closed. This article is not the place to discuss this complicated issue. Whether the door was closed, whether it can be closed at all, and at what level it is closed are all issues of vehement dispute.

The Mujtahid fi al-Madh’hab is not at the level of scholarship required to go off and establish his own school without referencing anyone else, however he has reached a level where he no longer requires anyone else’s views on any particular subject outside of usul. They are still confined to a school, however they directly derive rulings from the source texts without referencing anything beyond the foundational principles of that school. They are not allowed to follow the opinion of any other scholar and are required to follow their convictions only.

The Mujtahid Mutlaq has reached the highest level of scholarship in every Islamic discipline and is required to develop his own school, not being allowed to take anyone else’s conclusions over his own research and conviction.

b. What Are the Possible Outcomes of Fatwa?

A fatwa on a particular issue determines one of nine positions:

- Obligatory (fard or wajib)

- Highly recommended (Sunnah mu’akkadah)

- Recommended (Sunnah, mustahabb, tatawwu’)

- Slightly recommended (fadilah, raghibah)

- Allowable (mubah)

- Disliked/hated (makruh)

- Minor sin (saghirah, dhanb, ithm, sa’yyi’)

- Heretical innovation (bid’ah)

- Major sin (kabirah, fahsha, munkar)

- Disbelief or apostasy (shirk, kufr, ridda, nifaq akbar)

4. What is Economics?

According to Investopedia, economics is:

Economics is a social science concerned with the production, distribution, and consumption of goods and services. It studies how individuals, businesses, governments, and nations make choices about how to allocate resources. Economics focuses on the actions of human beings, based on assumptions that humans act with rational behavior, seeking the most optimal level of benefit or utility. The building blocks of economics are the studies of labor and trade. Since there are many possible applications of human labor and many different ways to acquire resources, it is the task of economics to determine which methods yield the best results.

There are multiple kinds of economic systems. Traditionally speaking, economics was managed less by the intentional design of powerful governments and more between the parties involved in transactions. As centers of commerce grew in size and complexity throughout history, a need to develop centralized regulations developed. With the rise of bigger civilizations and national trade agreements, highly complex systems of economics were created. These systems were diverse, and economic thought is highly debated.

a. The History of Capitalism

Capitalism is an economic system prioritizing the private ownership of wealth, the means of producing wealth, and the creation of profit. Modern capitalism stems from a seventeenth century European renaissance system called mercantilism. In the sixteenth century, a sect known as “Calvinism” was born from the the Protestant revolution. Calvinists propagated the theology that working for wealth was a form of worship and God’s acceptance of a person can be objectively measured by their worldly success.

b. Unique Features of Modern Capitalism

Modern Capitalism is based on a technique called “fractional reserve banking.” In fractional reserve banking, banks are allowed to lend out more money than its customers deposit. If a bank has five customers, each with one dollar to deposit, then it should have five dollars within its reserves at all times. If all five customers wish to withdraw their funds, they should be able to do so. However, in fractional reserve banking, banks calculate how likely it is that all five customers withdraw.

Since it is unlikely that all customers withdraw at the same time, the bank may loan out two dollars to other people. The banks’ reserves now contain only sixty percent (60%) of its depositors’ funds. The bank will then charge interest fees on the two dollars it loaned out, and obtain a profit. By the time all five original customers seek to withdraw their money, the bank has profited from the loans it gave out.

One of the main issues with fractional reserve banking is that banks profit off of the capital of their customers without being able to return it when their customers’ need it the most, causing “bank runs.” However, this only occurs during serious crises, and can often be mitigated by the government.

A more pertinent problem is that the interest-based loans which banks give out require them to be paid back with more money than exists in the entire money supply. Following on from the previous example, if ten banks each loan out two dollars, and each bank expects three dollars in return, then the entire economy must somehow produce an additional ten dollars which did not exist before. This creates fictional money in the form of debt, inflating asset prices throughout the entire market.

When debtors cannot afford to pay the non-existent interest on their loans, this causes bank customers to withdraw their money. Since the bank has loaned out much of their money, and even begun to loan out some of this fictional money produced by interest, the bank cannot return all of the money to its customers. This process of crashing back to reality, which causes the value of assets to return to more realistic numbers, is referred to as popping economic “bubbles.”

Bubbles are almost entirely caused by riba. However, fractional reserve banking has proven capable of creating bubbles which crash not only regional or national economies – but the entire international economic order.

In an economy managed by a central banks, the bursting of a bubble is called a “bear market.” A market which is growing, and ultimately creating a bubble, is called a “bull market.” Historically, commodities and indices managed by central banks always return to some sort of a bull market. Once a bubble pops and the market reaches a low, it will then seek to find a new all-time high.

As such, inflation through riba is necessary for markets to reach new heights. As long as a currency is managed by a central bank in a capitalist system, it can be expected to inflate, and the overall market’s value to “increase.” It increases in terms of larger numbers, however those numbers are created by inflation. As such, an investor in the market always stands to gain, and a person holding currency always stands to lose. Assets always increase in value in relation to the currency, as the currency is constantly devalued.

This cyclical upswing and downswing feeds into mass psychology and the public psyche. The market influences the emotional and psychological outlook of entire societies. Entire nations of people are indoctrinated into believing that more money and economic success means more happiness for more people. Large upswings for years and relatively short bear markets, no matter how devastating, keep people enthralled.

Markets create and break “price ranges” based on the laws of supply and demand. Price ranges are a low or a high within a given time period. The market inflects based on price (x-axis) and time (y-axis).

When a market fails to take out a new low in a given range, it will have an objective to take out the high. When a market fails to take out a new high, it has an objective to make a new low. This is why price-time charts go up and down, as it does this on a second-by-second, minute-by-minute, day-by-day, and even century-by-century basis.

Therefore, market indices will always return to some type of bull market as, once a true low is formed, the market will have a price objective to take out a new high outside of its given range – which is an all-time high. Instruments can only functionally fall to zero, whereas they can grow infinitely.

Markets and instruments rise slower than they correct, however they rise much more than they fall. In the same vein, instruments can only fall to having no worth, whereas they could theoretically grow infinitely and have continued growth over time. Money in a fiat system is illusory. It is a fundamentally synthetic instrument which has no intrinsic value. Hence, the recent seemingly illogical fluctuations in the market.

c. Is Capitalism Compatible with Islam?

Capitalism is born out of a form of Protestant Christianity wherein the physical incarnation of God on this earth, traditionally Jesus, was replaced with money. In a capitalist system, the greatest good is to produce wealth, and the greatest evil is to be impoverished. “Titans of industry” are celebrated while those who are crushed under the weight of the system are spurned.

Since work is understood as the primary form of worship to this idol, the capitalist system encourages working as much as possible, as often as possible, to create as much money as possible – irrespective of actual needs. Elon Musk, briefly the richest man in the world, works so much that:

With Tesla’s Model 3 production behind, Elon Musk is so busy he doesn’t even have time to go home and shower. And he’s sleeping on the floor of the factory.

In the same way that, ideally, the Muslim seeks to dedicate as much time and effort serving Allah, the worker in the capitalist system ideally seeks to dedicate as much time as possible producing wealth.

The French philosopher and Christian anarchist Jacques Ellul writes,

The bourgeois morality was and is primarily a morality of work and of metier. Work purifies, ennobles; it is a virtue and a remedy. Work is the only thing that makes life worthwhile; it replaces God and the life of the spirit. More precisely, it identifies God with work: success becomes a blessing. God expresses his satisfaction by distributing money to those who have worked well. Before this first of all virtues, the others fade into obscurity. If laziness was the mother of all the vices, work was the father of all the virtues. This attitude was carried so far that bourgeois civilization neglected every virtue but work.

Nothing belongs any longer to the realm of the gods or the supernatural. The individual who lives in the technical milieu knows very well that there is nothing spiritual anywhere. But man cannot live without the sacred. He therefore transfers his sense of the sacred to the very thing which has destroyed its former object: to technique itself. In the world in which we live, technique has become the essential mystery, taking widely diverse forms according to place and race. Those who have preserved some of the notions of magic both admire and fear technique. [The Technological Society]

We worship Allah because we owe Him for everything and He deserves worship. Yet, capitalism worships something else. Italian sociologist Maurizio Lazzarato writes:

We are no longer the inheritors of original sin but rather of the debt of preceding generations. “Indebted man” is subject to a creditor-debtor power relation accompanying him throughout his life, from birth to death. If in times past we were indebted to the community, to the gods, to our ancestors, we are henceforth indebted to the “god” Capital. [The Making of the Indebted Man: An Essay on the Neoliberal Condition]

Not only is the fundamental measurable unit of success in capitalism, the dollar, tied to riba in an integral fashion, but the point of gaining these units is to worship the idol of capital. In Islam, we gain ajr [good deeds] for the purpose of drawing closer to the One True God, Allah.

What is the result of worshiping other than Allah? What has capitalism produced? Former mathematics professor turned anarchist philosopher and domestic terrorist, Theodore Kaczynski, explains in his work:

“…but they have destabilized society, have made life unfulfilling, have subjected human beings to indignities, have led to widespread psychological suffering (in the Third World to physical suffering as well) and have inflicted severe damage on the natural world. The continued development of technology will worsen the situation. It will certainly subject human beings to greater indignities and inflict greater damage on the natural world, it will probably lead to greater social disruption and psychological suffering, and it may lead to increased physical suffering even in “advanced” countries.” [Technological Slavery]

d. Is there such as thing as “Islamic Economics”?

Islam has a fully-fledged economic system which is compatible with the modern world. It is superior to any other economic system mankind has ever produced. Islam’s economic system balances material and economic success with taking care of the needy. In Islamic economics, the goal is to provide quality of life for all people, meaningful work, while allowing the primary focus to remain on worshiping Allah. A perfect balance is struck between material comfort and mankind’s other needs.

Interest is abolished and mandatory charity is taken from Muslims (zakah). It is also possible to create an Islamic commercial banking structure. Currency would be based on bullion (precious metals). Imam Abu Zayd b. Khaldun, a great scholar of Islam and the founder of several sciences such as sociology, wrote,

ثم إن الله تعالى خلق الحجرين المعدنيين من الذهب و الفضة قيمة لكل متمول، و هما الذخيرة و القنية لأهل العالم في الغالب. و إن اقتنى سواهما في بعض الأحيان فإنما هو لقصد تحصيلهما بما يقع في غيرهما من حوالة الأسواق التي هما عنها بمعزل فهما أصل المكاسب و القنية و الذخيرة.

Then, surely Allah – Exalted – created the two precious stones from gold and silver. They are the measure for all capital. They are the preferred [basis] of treasure and property among those who have knowledge. [That is the case] even if something else suffices in their stead sometimes, from what happens besides them in marketplace transactions which are subject to fluctuations, as they are utilized for the purpose of obtaining those two. They are the root of profit, property, and treasure. [Muqadimma by Abu Zayd b. Khaldun]

Islamic economics has a long and robust history which may be researched elsewhere.

5. What Kind of Financial Instruments or Transactions Are Prohibited?

Keeping in mind the qawa’id of fiqh: all worldly matters (with some important exceptions) are permissible until explicitly proven haram (الأصل في الأشياء الإباحة) and difficulty demands ease (المشقة تجب التيسير), then the default of all financial instruments and transactions is that they are either mubah or better (up to fard). If a specific proof from the Qur’an or Sunnah prohibits them, they contradict a qa’idah of fiqh, or a maqsad shar’i – only then will that default ruling change.

a. Interest and Usury

Interest is the process of reaping profit on a loan. Money or assets are given by a creditor to be borrowed by a debtor for a period of time, with the stipulation that more is returned. This can be in installments or all at once. This is known as riba.

i. The Prohibition of Riba

Riba is not only expressly prohibited in the Qur’an and Sunnah, it is deemed as a major sin (kabira). Allah تعالى says about riba:

الَّذينَ يَأكُلونَ الرِّبا لا يَقومونَ إِلّا كَما يَقومُ الَّذي يَتَخَبَّطُهُ الشَّيطانُ مِنَ المَسِّ ۚ ذٰلِكَ بِأَنَّهُم قالوا إِنَّمَا البَيعُ مِثلُ الرِّبا ۗ وَأَحَلَّ اللَّهُ البَيعَ وَحَرَّمَ الرِّبا ۚ فَمَن جاءَهُ مَوعِظَةٌ مِن رَبِّهِ فَانتَهىٰ فَلَهُ ما سَلَفَ وَأَمرُهُ إِلَى اللَّهِ ۖ وَمَن عادَ فَأُولٰئِكَ أَصحابُ النّارِ ۖ هُم فيها خالِدونَ

Those who practice usury will not rise from the grave except as someone driven mad by Shaytan’s touch. That is because they say, ‘Trade is the same as usury.’ But Allah has permitted trade and He has forbidden usury. Whoever is given a warning by his Lord and then desists, may keep what he received in the past and his affair is Allah’s concern. But all who return to it will be the Companions of the Fire, remaining in it timelessly, for ever.

[Surah al-Baqarah, The Heifer (2):275]

Allah continues:

يا أَيُّهَا الَّذينَ آمَنُوا اتَّقُوا اللَّهَ وَذَروا ما بَقِيَ مِنَ الرِّبا إِن كُنتُم مُؤمِنينَ

You who have iman! have taqwa of Allah and forgo any remaining usury if you are believers.

فَإِن لَم تَفعَلوا فَأذَنوا بِحَربٍ مِنَ اللَّهِ وَرَسولِهِ ۖ وَإِن تُبتُم فَلَكُم رُءوسُ أَموالِكُم لا تَظلِمونَ وَلا تُظلَمونَ

If you do not, know that it means war from Allah and His Messenger. But if you make tawba you may have your capital, without wronging and without being wronged.

[Surah al-Baqarah, The Heifer (2):278, 279]

Riba is war upon Allah and His Messenger ﷺ, a war which no person can ever survive without losing their eternity. It must be avoided by the believers at all costs. All partners were cursed on the tongue of the noble Prophet Muhammad ﷺ:

Narrated Jabir – may Allah be pleased with him,

Allah’s Messenger (ﷺ) cursed the one who accepts usury, the one who gives it, the one who records it and the two witnesses to it, saying, “They are all the same.” [Sahih al-Imam Muslim, 1598]

عَنْ جَابِرٍ - رضى الله عنه - قَالَ: { لَعَنَ رَسُولُ اَللَّهِ - صلى الله عليه وسلم -آكِلَ اَلرِّبَا, وَمُوكِلَهُ, وَكَاتِبَهُ, وَشَاهِدَيْهِ, وَقَالَ: ” هُمْ سَوَاءٌ ” } رَوَاهُ مُسْلِمٌ 1 .

Trade is different than riba in that it is a mutual exchange of different types of goods or services, not the same kind. It becomes riba only when the same item is traded at different quantities. Some kinds of riba are:

- Riba al-qurud

- Riba al-buyu’

- Riba al-fadl

- Riba al-nasa

Discussing the various kinds of riba is beyond the scope of this research.

ii. Entropy

Entropy is a scientific concept and measurable property of all physical systems. The rules of entropy indicate that systems move from a state of order to disorder. This occurs on small levels and larger ones. In order for a system to be moved from disorder to greater order, it requires a greater amount of disorder to occur within a larger system or an equal one.

Entropy is observed all around us. Vegetables expiring are undergoing entropy. People becoming old and dying experience entropy. Buildings which are not taken care of become dilapidated. A teenager’s room which is not tidied up becomes messy. The environment is experiencing constant decay. Some scientists believe that the universe itself will experience a final entropic state called “heat death.”

Entropy is highly relevant to the discussion of riba. Riba assumes that a person can borrow ten dollars ($10), utilize that $10 to create greater order, then be able to return eleven dollars ($11) – either breaking even or profiting. To highlight how irrational this is, an example taken from Tarek Diwany’s “The Problem with Interest” is given:

Imagine a person borrows three loaves of bread. If he is expected to return them in a week, then those loaves become moldy, or are needed for food, and depreciate in value. It is possible for him to preserve them, but then there would be no purpose to the loan, or to consume them and produce three more loaves. However, if he is expected to produce four loaves in return, then that means not only must his original three loaves not depreciate in value, by mold or otherwise, but they must somehow give birth to a fourth loaf. If the interest is compounded, then even this baby fourth loaf will be required to produce another loaf of bread.

As ridiculous as this sounds, the entire global capitalist system is based on a similar concept. Since riba involves entropy, it opposes Allah’s natural physical order which He created the world in. As such, it causes wide-scale economic disaster and the modern capitalist system can only exist by creating great amounts of entropy in our world: through war, subjugation, unjust slavery, widespread unhappiness, dissolution of the family unit, dehumanization, and environmental disaster.

iii. Discounting

Discounting is riba working in reverse. In discounting, instead of receiving more money for the same loan or asset over time, the person receives less. A determination is made as to the present value of an asset or loan in the future, and a price is set now. It can be thought of as interest working in reverse, as the creditor or seller gains more by loaning or selling now than in the future.

Discounting is how riba is fundamentally intertwined with modern fiat currencies. It is the primary way in which the money supply increases. Over time, the value of the United States Dollar is intentionally depreciated and discounted so that assets can raise in value with respect to it, also creating more money within the money supply, and raising GDP. This kind of artificial economic “growth” does lead to some real growth, however it also leads to bubbles.

The United States Dollar and all fiat currencies managed by central banks are fundamentally riba instruments. By owning these dollars, a person is engaging in a riba system.

b. Gambling and Uncertainty

The Shari’a also prohibits gambling and transactions involving a great deal of uncertainty. Allah ﷻ says:

يَسأَلونَكَ عَنِ الخَمرِ وَالمَيسِرِ ۖ قُل فيهِما إِثمٌ كَبيرٌ وَمَنافِعُ لِلنّاسِ وَإِثمُهُما أَكبَرُ مِن نَفعِهِما ۗ وَيَسأَلونَكَ ماذا يُنفِقونَ قُلِ العَفوَ ۗ كَذٰلِكَ يُبَيِّنُ اللَّهُ لَكُمُ الآياتِ لَعَلَّكُم تَتَفَكَّرونَ

They will ask you about alcoholic drinks and gambling. Say, ‘There is great wrong in both of them and also certain benefits for mankind. But the wrong in them is greater than the benefit.’ They will ask you what they should give away. Say, ‘Whatever is surplus to your needs.’ In this way Allah makes the Signs clear to you, so that hopefully you will reflect. [Surah al-Baqarah, The Heifer (2):219]

Also:

يا أَيُّهَا الَّذينَ آمَنوا إِنَّمَا الخَمرُ وَالمَيسِرُ وَالأَنصابُ وَالأَزلامُ رِجسٌ مِن عَمَلِ الشَّيطانِ فَاجتَنِبوهُ لَعَلَّكُم تُفلِحونَ

You who have iman! wine and gambling, stone altars and divining arrows are filth from the handiwork of Shaytan. Avoid them completely so that hopefully you will be successful.

إِنَّما يُريدُ الشَّيطانُ أَن يوقِعَ بَينَكُمُ العَداوَةَ وَالبَغضاءَ فِي الخَمرِ وَالمَيسِرِ وَيَصُدَّكُم عَن ذِكرِ اللَّهِ وَعَنِ الصَّلاةِ ۖ فَهَل أَنتُم مُنتَهونَ

Shaytan wants to stir up enmity and hatred between you by means of wine and gambling, and to debar you from remembrance of Allah and from salat. Will you not then give them up? [Surah al-Ma’idah, The Tablespread (5):90-91]

Gambling is known as maysar. Uncertainty is known as gharar. Any kind of short-term investing strategy can have aspects of either or both, whereas long-term investing strategies can avoid both if done correctly. If the underlying value of the asset is important and the investor invests based on knowledge, not speculation, then they can remove maysar and gharar.

i. Maysar

Much of modern financial markets would be deemed gambling (maysar). It is not absolutely necessary to gamble in order to own assets in a capitalist system, however it must be consciously avoided.

Maysar has three components:

- Playing with money or assets in order to win money or assets;

- Risking money or assets due to randomness, and;

- Lack of control or ability to create an objective advantage.

If all players or investors stand an equal chance of loss, or you do not control the risk or loss probability, then this is gambling.

This occurs with stocks, even if the underlying business is not engaged in any haram activity, as many stocks do not have positive cash-flow or revenues. They have increasing debt. If there is no underlying value to the asset and a person simply speculates that it will increase in value, this would technically meet the criteria of gambling.

iii. Gharar

Gharar is uncertainty in transactions. When a person is unsure what they are buying, whether they will receive the product, or similar levels of doubt as to the deal – then it becomes haram to engage in it.

c. Permissible Risks in Economics and Finance

Not all risks in finance are haram. If a person avoids riba, maysar, and gharar, then, so long as there is nothing else intrinsically prohibited about the transaction, they may engage in it. All business and trade contains the possibility of loss or failure. This can be hedged by a variety of strategies, however the maqsad of the shari’a is hifzh al-mal, and a person should be prudent. Allah commands:

وَلا تُؤتُوا السُّفَهاءَ أَموالَكُمُ الَّتي جَعَلَ اللَّهُ لَكُم قِيامًا وَارزُقوهُم فيها وَاكسوهُم وَقولوا لَهُم قَولًا مَعروفًا

Do not give the simple-minded your property for which Allah has made you responsible, but provide for them and clothe them out of it, and speak to them correctly and courteously. [Surah al-Nisa, Women (4):5]

6. What is Currency?

A currency is a medium of exchange. There is no strict Islamic definition as to what constitutes a currency or does not.

In a fiat system, money is an illusory and a fundamentally synthetic instrument with no intrinsic value – similar to Bitcoin. The primary difference between Bitcoin is the underlying technology which provides a slew of benefits that fiat does not. Fiat, however, has an advantage in being able to have the support of powerful nation-states which can use their might to ensure the currency’s value.

a. History of Currencies

In southern Iraq, the civilization of Babylon was situated between the Tigris and Euphrates rivers. Such river valleys are known as “cradles of civilization,” as they provide fertile soil and irrigation that supports surplus farming. With a surplus of produce or staple food, which have intrinsic value, items began to be traded. This created a “barter economy.”

However, staple foods or other produce are highly limited. Individual food items are not highly valuable, so massive quantities are required in order to purchase things which are expensive. Portability and delivery costs become problematic. Furthermore, food items expire relatively quickly.

Without a standard of measure, individual items could be accepted by one vendor and not another. Or they could be accepted at different rates. The economy becomes highly obtuse and obfuscated. It is highly impractical to keep various kinds of food on hand.

Allah سبحانه provided us with a solution:

زُيِّنَ لِلنّاسِ حُبُّ الشَّهَواتِ مِنَ النِّساءِ وَالبَنينَ وَالقَناطيرِ المُقَنطَرَةِ مِنَ الذَّهَبِ وَالفِضَّةِ وَالخَيلِ المُسَوَّمَةِ وَالأَنعامِ وَالحَرثِ ۗ ذٰلِكَ مَتاعُ الحَياةِ الدُّنيا ۖ وَاللَّهُ عِندَهُ حُسنُ المَآبِ

To mankind the love of worldly appetites is glowingly beautified: women and children, and heaped-up mounds of gold and silver, and horses with fine markings, and livestock and fertile farmland. All that is merely the enjoyment of the life of this wotld. The best homecoming is in the presence of Allah. [Surah Al ‘Imran, ‘Imran’s House (3):14]

Even in Paradise, Muslims are promised gold. Gold and silver have the ideal qualities to suffice man’s need for a stable medium of exchange. They can be transformed into inherently functional tools, do not expire, are naturally desirable, naturally occurring, limited by definition – they solve the problems of the barter system.

In Egypt, gold and silver were standardized into currency. In fact, the Prophet Yusuf عليه السلام was sold into slavery at the price of a few silver coins. The kingdoms of China, Lydia, Athens, Rome, and Persia adopted this medium of exchange. In Persia, the drachma was coined.

During the Madinan period, RasulAllah ﷺ established a state which provides a model for all of mankind in all aspects (Din). The Madinan state included bartering, but also utilized the Roman gold dinar, Persian dirham, and Persian copper fals.

The civilization of Islam spread across the globe, from East to West. With the spread of Islam and khilafah, came the spread of bullion currency. In 77 AH, caliph ‘Abd al-Malik b. Marwan minted the first Islamic dinar. He also instituted a system of weighing coins to ensure that they were not fraudulently shaved down.

In non-Muslim Europe, currency exchangers would charge a fee to exchange bullion coins from one kingdom’s currency to another. They also began earning interest on loans. The banks would earn profit from their customer’s money, which they did not own. From here, modern banking was born.

Fractional reserve banking was created in these banks. When Europeans deposited their gold in banks, they would receive promissory notes – notes that promise to return a certain number of gold coins upon receipt. The wealth was in the coins, but not the notes. However, these receipts began being utilized as payment themselves, with the promise of coins at will from the bank.

The first modern bank was the Reserve Bank of England. However, the English government required that promissory notes be utilized and officialized them. This model was copied around Europe and eventually the United States, where the Federal Reserve, a private corporation with a monopoly on printing promissory notes (dollar bills) was created.

Gold receipts eventually transformed into bank checks. Instead of handing out coins, these checks would dole out promissory notes. However, these bank checks were still theoretically redeemable for gold. These bank checks became fiat currency.

During World War I, European nations could no longer fund their armies with gold. They divorced their notes from gold in order to print more of them and supply their armies. This caused unbelievable inflation, especially in losing nations, such as Germany cum Weimar Republic.

In 1933, the United States government forcibly collected “all gold coin, gold bullion, and gold certificates” owed to the public by the Federal Reserve. The new dollar was not redeemable for gold, but only other reserve notes. Gold and silver were removed as a medium of exchange, and instead a piece of paper with no inherent value was instituted.

After World War II, the United States had collected a sizable portion of the world’s gold reserves by selling munitions for it. in 1940, they organized the Bretton Woods convention. In this convention, only the United States dollar was redeemable for gold, and only by foreign nations. Therefore, nations had to sell their gold to get United States dollars. The Federal Reserve became the bank for all other international banks, and the standard which all banks needed to do trade.

After witnessing the mass printing of dollars during the Vietnam war, other nations began ringing the alarm bells and withdrawing gold for dollars en masse. Nixon annulled Bretton Woods and cancelled gold redemption. The dollar was totally divorced from gold. This paved the way for Modern Monetary Theory.

Digital dollars are now allowed to be created from thin air as bank credits. Not even paper dollars are backing many of these virtual numbers upon which the entire international economy is based. Due to this, debt is always greater than the money in the money supply. The amount owed is always greater than the amount of money created. Hence, periodic bubbles destroy this imaginary wealth.

In 1960, the Organization of the Petroleum Exporting Countries (OPEC) was created. The United States utilized its pressure on Saudi Arabia, a major member of OPEC, to ensure that petroleum oil would only be sold with United States dollars. Therefore, the United States dollar become theoretically backed by wealth stolen from Muslims by oppressive governments.

b. Islam and Money

The fuqaha have different views on what constitutes money. Some of them mention three conditions: monetary value, shar’i value, and private value.

c. Monetary Value

Monetary value is known as thamaniyya. A currency must:

- Have a standard of value

- Be utilized to measure things against

A currency must have thamaniyya in order to properly value assets against a standard. Otherwise, another benchmark will be utilized, and the item in question is no longer a medium of exchange.

For thamaniyya to occur, it has to have some degree and acceptance. Gharar and severe volatility undermine thamaniyya.

d. Shar’i Value

For a currency to be valid, it has to have value according to the shari’a. In the shar’ia something is valuable if it is halal to deal in and is considered to be wealth (mal).

e. Private Value

Private value is known as mal. Mal is something which is acquired and possessed. It must be able to either have immediate utility or be able to be stored and considered to have worth in some meaningful fashion.

f. Permissibility of Fiat Currency

It should be clear due to the preceding discussions regarding the discounting inherent in fiat that they are not permissible as a hukm (theoretical ruling). Fiat has no thamaniyya nor shar’i value. However, due to ‘Umum al-Balwa (ubiquituousness of an affliction), they may be utilized. There is no way to realistically escape fiat in the modern world yet. That does not mean that Muslims should not seek alternatives. However, considering the impermissibility of fiat and its incapability of meeting the definition of a valid shari’i currency, it leads sound-minded Muslims to begin pursuing other alternatives.

7. What is the Blockchain?

Most cryptocurrencies, including Bitcoin, are based on a distributed databases. A database is simply an electronic collection of organized data. Data are collected facts. Databases organize data for the purpose of extracting meaningful information.

The databases which cryptocurrencies are based on are known as “blockchains.” Blockchains are essentially decentralized virtual ledger books, replete with pages known as “blocks.” Each page in a ledger is composed of paragraph entries, which are the actual transactions in the block.

Blockchains store information in the form of numerical transactions, which are just numbers. We can consider these numbers digital assets, such as Bitcoin. The data in a blockchain is immutable and recorded only by consensus-based algorithms. Bitcoin is cryptographic and all transactions are direct, without intermediary, peer-to-peer.

a. Blocks

Blocks are the smallest unit of a blockchain, containing transactions. A block is the page in the ledger. Blocks are virtually created by a list of transactions, a signature validating the page, and a number produced by algorithms (known as a nonce) of previous blocks by miner nodes.

A miner is a computer that processes cryptocurrency transactions. They make sure all of the transactions recorded are valid, write them to the blocks, and keep copies of the entire blockchain. In reward for this, they are given some of the cryptocurrency.

b. Proof Algorithms

Proof algorithms are computer formulas which are used to validate a block. A proof verifies that every transaction on a block is legitimate, so that the block can be finished, and a new block started. There are about twenty different proof algorithms.

c. Blockchain Security

The blockchain provides numerous benefits for online transactions. It has many features which make it incredibly secure. Since the database is decentralized, blockchains have no single point of attack. The cryptocurrency owner or blockchain user has no need to trust a company, government, or individual. The trust is place in encryption and cryptography, which are computer security measures.

Blockchains are open-source and can be audited at any time. The records are totally transparent, while simultaneously maintaining confidentiality as each wallet has a randomly generated address – protecting the “right to be forgotten.” Decision making is done as a collective. It is impossible for fraud to occur or a block to be deleted. It is highly sustainable and accessible.

e. Blockchain Ecosystems

The blockchain is public. Anyone can read and write to it utilizing the proper software without needing authorization. This is acceptable because it has complex rulesets for security and integrity, including a consensus algorithm for transaction confirmation. Ownership is distributed.

Since it is computationally difficult and expensive to mine or add a block, miners are rewarded. Since miners increase blockchain integrity, they are incentivized by being given crypto as a reward for dedicating their computer power. Not all blockchains have miners, but Bitcoin does.

Cryptocurrencies are traded on exchanges, which are companies that either own a large amount of cryptocurrency and sell it or allow people to list their crypto for sale.

Additionally, some blockchains allow for smart contracts and decentralized applications.

8. What is Cryptocurrency?

There are around ten-thousand (10,000) cryptocurrencies now. As such, this discussion will focus on the first and most popular: Bitcoin.

Bitcoin was created in 2008 by a now famous mysterious figure known as Satoshi Nakamoto and its open source code was released in 2009. It was the first decentralized cryptocurrency to utilize a novel protocol known as the blockchain. Up to one megabyte of data may be sent with each transaction. It is decentralized, anonymous, transparent, easy to set-up, and provides myriad other benefits. Bitcoin is not backed up by anything other than its own technology.

If the dollar is the currency of the United States and the yen the currency of Japan, Bitcoin is the currency of the internet.

a. Differences with Other Technologies

Bitcoin can never be expected to collapse as a framework, even were it to become worthless. The stock market has the potential to collapse in its entirety, whereas, as long as the internet exists, Bitcoin will be a functional system with a self-authenticating framework. That capacity to persist regardless of the actual price of Bitcoin and the deflationary nature of Bitcoin means that it has something which fiat does not – inherent value.

i. Decentralized Apps and Contracts

Decentralized apps or smart contracts are applications which do not require users to depend on developers by providing them with personal information or funds. A contract is a program that exists within a blockchain network, with its own value, memory, and code. When a transaction is sent through a contract, it executes its code dependent on its memory and can facilitate other transactions, along with working with other contracts. This places the dependence of the user on the developer into a new decentralized realm. These contacts are maintained by the blockchain network, without any individual having total ownership.

These kinds of financial applications empower users by allowing them to enter into contracts at will, with whatever conditions they agree upon, giving them freedom with their capital. Hedging contracts, savings accounts, wills, and employment contracts all fall under this domain. Many kinds of capital and non-capital goods, such as services, can be traded on such a platform – including totally decentralized marketplaces.

Non-monetary applications involve things like voting and other means of bartering or exchanging information. A decentralized data feed is also possible, through use of giving a certain number of individuals a token, and requesting they spend it in a shared contract. Each individual given a token will be incentivized to tell the truth to be a part of the larger token pool, compromised of people who convey the data as correctly as possible and sent their tokens there. Token systems can be used through sub-currencies that represent assets such as gold, the Yen, company stock, or ballots. These systems are easy to apply to currency like Ethereum as it is geared toward them; the logic must simply be implanted into a contract.

More complex contracts require third-party data separate from the blockchain, such as a Bitcoin to USD exchange rate. Blockchains such as Ethereum simply accept this third-party data. It considers a system of moving data from one trusted source to a certain number of semi-trusted sources to be distributed along the Ethereum network. Having semi-trusted oracles, with a reputation system for verifying contracts, of which multiple are required before a contract is completed and the transaction executed, would eliminate the need for trust by removing fear of a single oracle stealing funds. However, a universal contract language must be created for these oracles.

Islamic contracts are possible on these blockchains and would be executed without government oversight. Some of the kinds of possible contracts include:

- Contracts of Exchange (murabaha, bay’ al-salam, ijara, istisna);

- Contracts of Charity (Qard hasan, hiba, waqf);

- Contracts of Investment (Mudarabah, musharakah), and;

- Miscellaneous contracts (Rahn, daman, wadia)

b. Benefits of Bitcoin

Bitcoin does not require trust in a central bank. It requires trust in the technology behind it, which is open source and may be evaluated by anyone at any time. Furthermore, it is impossible to manipulate as doing so would require all of the nodes in the network to be hacked at once – unlike the stock market which is manipulated by the government and “Market Makers”. Bitcoin is also private in that, though the ledger is openly distributed, it is encrypted. Bitcoin’s blockchain has one of the greatest redundancy and information disaster recovery systems ever developed.

Bitcoin has a distributed governance model in that it is controlled by its users. There is no need to trust a payment processor or bank, or even to pay fees to such entities. There are also no third-party fees for transaction processing. As the ledger is immutable and transparent it is never possible to change it – the data on the blockchain is permanent. The system is not easily susceptible to attacks as it is widely distributed. Furthermore, as users of Bitcoin have their private keys assigned to their transactions, they are virtually impossible to fake. No lengthy verification, reconciliation, nor clearing process exists with Bitcoin.

Bitcoin is based on a proof-of-work algorithm. Every transaction on the network has an associated mathematical “puzzle.” Computers known as miners compete to solve the complex cryptographic hash algorithm that comprises that puzzle. The solution is proof that the miner engaged in sufficient work. The puzzle is known as a nonce, a number used only once. There is only one major nonce at a time and it issues 12.5 Bitcoin. Once it is solved, the fact that the nonce has been solved is made public.

A block is mined on average of once every ten minutes. However, the blockchain checks every 2,016,000 minutes (approximately four years) if 201,600 blocks were mined. If it was faster, it increases difficulty by half, thereby deflating Bitcoin. If it was slower, it decreases, thereby inflating Bitcoin. It will continue to do this until zero Bitcoin are issued, projected at the year 2140. On the twelfth of May, 2020, the blockchain will halve the amount of Bitcoin issued when each nonce is guessed. When Bitcoin was first created, fifty were issued per block as a reward to miners. 6.25 BTC will be issued from that point on once each nonce is solved.

Unlike fiat, Bitcoin is a deflationary currency. As BTC becomes scarcer, demand for it will increase, also raising the price. In this, BTC is similar to gold. It is predictable in its output, unlike the USD, as it is based on a programmed supply. We can predict BTC’s deflation and inflation almost exactly, if not exactly. Only 21 million BTC will ever be produced, unless the entire network concedes to change the protocol – which is highly unlikely.

c. Detriments to Bitcoin

Some of the drawbacks to BTC include congestion. At peak congestion, it may take an entire day to process a Bitcoin transaction as only three to five transactions may be processed per second. Receiving priority on a payment may cost up to the equivalent of twenty dollars ($20). Bitcoin mining consumes enough energy in one day to power a single-family home for an entire week.

Bitcoin has no tangible value outside of the advantages its technology provides. This could be considered a detriment. However many kinds of software are only valuable insofar as they provide a virtual service or advantage.

Bitcoin’s volatility is often used as a reason to deride it. However volatility in-and-of itself is not a value determination. Some argue that since Bitcoin is not backed by a government, that it is unstable. However, such an objection betrays deep ignorance about the purpose and philosophy behind Bitcoin.

One of the most specious arguments against Bitcoin is that it is used by criminals to conduct nefarious transactions. The problem with this argument is that it ignores that the primary currency in which most criminal activity is conducted throughout the world is the United States Dollar.

The question as to whether cryptocurrencies are even currencies or just investment vehicles, or neither, is another vector of critique. Currencies must be store of short- or long-term value, a hedge against inflation, a safe haven for investments, a tail protection against market crashes, or provide some other vehicle to act as an exchange of wealth. The original Bitcoin whitepaper describes its purpose as:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. [“Bitcoin: A Peer-to-Peer Electronic Cash System“]

Bitcoin has proven itself to hold some value (not drop to zero), hedge against inflation, increase in value in terms of investments, and provide relative stability against market crashes.

d. What Problems Does Cryptocurrency seek to solve?

Cryptocurrencies and the blockchain were initially created to solve several issues. Some of these include: arbitrary interest-based inflation, centralization, lack of privacy, transaction fees, and government control.